Revolutionizing Credit: How Marmara Credit Loops are Changing the Game

Marmara Credit Loops: Reinventing Credit in the Blockchain Era

Welcome to the future of finance, where the age-old concepts of money and credit are being revolutionized right before our eyes! Imagine a world where the risks and limitations of traditional credit systems are a thing of the past, replaced by a groundbreaking, blockchain-powered marvel: Marmara Credit Loops (MCL). This isn't just another financial fad; it's a seismic shift in how we think about, use, and benefit from credit. In this blog post, we're diving headfirst into the fascinating world of MCL – a realm where security, efficiency, and mutual benefit aren't just ideals, but everyday realities. Buckle up as we embark on an exhilarating journey through the intricate workings of MCL, and discover how it's setting the stage for a financial revolution! 🚀💰🌐

Revolutionizing Credit: How Marmara Credit Loops are Changing the Game

Marmara Credit Loops: Reinventing Credit in the Blockchain Era

Money and Credit: Understanding the Difference

Before we delve into the innovative world of Marmara Credit Loops (MCL), let's take a moment to understand the basic concepts of money and credit. Money, in its simplest form, is what you have in your hand, earned from your past work. Credit, on the other hand, is future money - a promise to pay later for value received today. Traditional financial instruments like post-dated cheques and promissory notes have long been used to create this credit, but they come with inherent risks, primarily the risk of nonredemption, where the issuer fails to settle their debts.

At its core, money is an information tool that shows us how much we can consume. But there's more to it than just the cash in our hands. There's another form, known as credit money, that's shaping our financial future.

Understanding Credit: The Basics

Let's break it down. There are two types of money: cash, which you have earned through your work, and credit, which is essentially money created now but whose value is paid or met in the future by the issuer. Traditional methods like post-dated checks and promissory notes let issuers create credit immediately upon issuance but settle it later, carrying the risk of default. Meanwhile, the holder, who essentially finances the issuer by accepting this credit, doesn't earn from this process – they just get an easier way to find customers.

Types of Credit

Financial Credit: This refers to the credit provided by financial institutions like banks. It's based on the banking system's assessment of creditworthiness and is often used for transactions in the broader economy. Financial Credit is more abstract and is tied to the financial policies and stability of institutions.

Real Credit: Real Credit is directly linked to the real economy. It involves peer-to-peer transactions like post-dated cheques or promissory notes. This type of credit is grounded in actual goods, services, or labor. It's a more tangible form of credit, reflecting the real productive capacity and resources of individuals or businesses.

The Game-Changing Marmara Credit Loops

Marmara Credit Loops is revolutionizing this traditional credit system with a groundbreaking approach on the blockchain. In MCL, the issuer fully collateralizes each credit loop, meaning they lock in an equivalent amount of money on the blockchain. This action effectively eliminates the risk of nonredemption, as the credit is already backed by real value.

Experience the Power of Consumer-Friendly Finance with Marmara Credit Loops

Imagine a world where your credit not only serves its purpose but also earns for you - a world where financial transactions are not just about spending but also about growing your assets. This is not a distant dream anymore; it's a reality with the Marmara Credit Loops (MCL) system. In MCL, the concept of credit undergoes a transformative makeover, morphing from a mere financial obligation into an opportunity for enrichment.

The Magic of 100% Collateralization

In MCL, consumers, or issuers of credit, provide full collateral for the credit they create. This means they back their credit with an equal amount of value upfront. But here's where it gets fascinating: by providing 100% collateral, consumers earn the right to a powerful financial tool - the privilege of 3x staking until the credit's maturity date.

3x Staking: A Game-Changer for Consumers

3x staking is like planting a seed and watching it grow threefold. For consumers in the MCL system, this means their collateral isn’t just sitting idle; it's actively working for them, multiplying in value over time. This feature not only adds an extra layer of security to their credit but also turns their financial activity into a rewarding experience.

Endorsers Pass the Baton, Consumers Reap the Rewards

As the credit loops through the system, endorsers pass the staking rights to new holders. However, the original consumer retains their privilege of 3x staking throughout the credit's lifecycle. This unique aspect of MCL ensures that consumers are continuously rewarded for their participation in the credit loop, making MCL an exceptionally consumer-friendly system.

The Holder's Advantage in MCL

Unlike traditional systems where the holder of a cheque or note merely facilitates the transaction without any direct benefit, MCL transforms the holder into an active participant. Both the issuer and the holder engage in a process called '3x Staking', which generates block rewards on the Marmara Chain. This way, the holder not only aids in the credit process but also earns from it, creating a mutually beneficial ecosystem.

MCL vs. Traditional Credit Systems: A Comparative Analysis

Elimination of Nonredemption Risk: With full collateralization, MCL ensures that each credit is backed by actual value, completely removing the risk of nonredemption.

Consumers are Kings: In the innovative Marmara Credit Loops (MCL) system, consumers experience unprecedented financial empowerment. By providing 100% collateralization for the credits they issue, consumers unlock the unique privilege of engaging in 3x staking until the maturity of the credit, transforming their collateral into a dynamic, value-multiplying asset. This mechanism ensures that consumers are not just participants but active beneficiaries in the credit loop, reaping continuous rewards as their financial contributions grow over time. MCL thus redefines the consumer's role in the financial landscape, turning every credit transaction into an opportunity for personal financial growth and empowerment. Consumers, i.e. the issuers provide the earning for both themselves and all holders in credit loops.

Active Earnings for Holders: The staking mechanism allows both issuers and holders to earn from the credit, a stark contrast to traditional systems where only the issuer benefits.

Dynamic Credit Creation: MCL's use of blockchain technology facilitates a more dynamic and fluid credit creation process, adapting to modern financial needs.

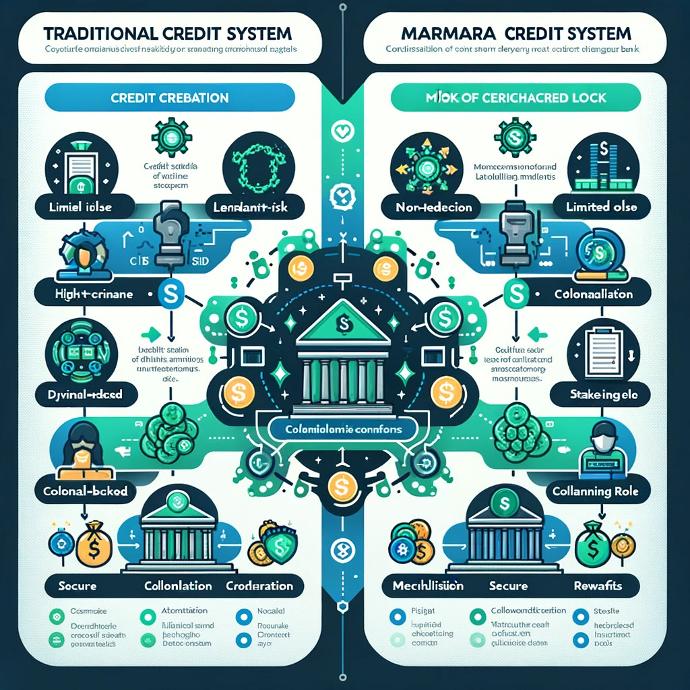

The diagram visually compares the Traditional Credit System with the Marmara Credit Loops (MCL). Key differences highlighted include the immediate creation of credit in the traditional system, which carries the risk of nonredemption, versus the fully collateralized credit in MCL, which allows for earnings through 3x staking. This illustration succinctly captures the fundamental shifts in credit creation and management between the two systems.

Here's a table comparing the Traditional Credit System and the Marmara Credit Loops (MCL) across several key features. This comparison highlights the differences in credit creation, risk management, benefits to the holder, collateralization, and earnings mechanisms, illustrating how MCL innovates and improves upon traditional systems.

| Aspect | Traditional System (Post Dated Cheques and Promissory Notes) | MCL System |

|---|---|---|

| Credit Creation | Immediate upon issuance | Created over time (3x Staking) |

| Risk of Nonredemption | High risk | No risk (fully collateralized) |

| Holder Earnings | Limited or none | Notary Earnings through 3x staking |

| Collateralization | Not required | 100% collateralization |

| Technology | Conventional (on papers) | Blockchain-based |

| Fraud Risk | High (risk of duplicates, alterations) | No risk (digital and secure) |

| Risk of Loss | Possible (physical documents) | No risk (digital format) |

| Divisibility | Limited (higher amounts due to bank blockages) | High (any amount can be issued) |

| Traceability | Limited (physical endorsements) | High (all transactions are digital records accessible) |

| Issuer Earnings | Issuer creates credit without earning | Earns through 3x staking until maturity date |

The table provides a detailed comparison between the Traditional Credit System and the Marmara Credit Loops (MCL) across several key aspects:

Credit Creation:

Traditional System: Credit is created immediately at the time of issuance. This means when a post-dated cheque or promissory note is issued, the credit is considered active from that moment.

MCL System: Credit is not created immediately. Instead, it's generated over time through a 3x staking process on the Marmara Chain. This ensures that credit is backed by actual value as it matures.

Risk of Nonredemption:

Traditional System: There is a high risk of nonredemption, which means the issuer might fail to settle the credit when it matures.

MCL System: There is no risk of nonredemption as every credit loop is fully collateralized. The issuer provides the total value upfront, ensuring they can cover the credit at maturity.

Holder Earnings:

Traditional System: The holder of a traditional credit instrument, like a post-dated cheque, does not earn from the process. They merely facilitate the transaction.

MCL System: Both the issuer and holder can earn through the staking process, making it a mutually beneficial system. Issuer can earn from 3x staking until he/she makes endorsement/transfer of credit to a new holder.

Collateralization:

Traditional System: No collateralization is required. The credit is based purely on trust and the issuer's promise to pay.

MCL System: 100% collateralization is required. This means the issuer must lock in an equivalent amount of value on the blockchain to back the credit.

Technology:

Traditional System: Uses conventional, non-digital methods like paper-based cheques and notes.

MCL System: Employs advanced blockchain technology, ensuring security, transparency, and efficiency.

Fraud Risk:

Traditional System: High risk due to the possibility of counterfeit cheques, alterations, or unauthorized endorsements.

MCL System: Virtually no risk of fraud. The digital nature and blockchain's security mechanisms prevent unauthorized alterations or counterfeits.

Risk of Loss:

Traditional System: Physical documents can be lost or damaged, posing a risk of losing the credit altogether.

MCL System: No risk of physical loss as everything is stored digitally on the blockchain.

Divisibility:

Traditional System: Limited divisibility. Higher amounts are often set due to bank blockages restrictions, making small transactions impractical.

MCL System: High divisibility, allowing for transactions of any size. This flexibility makes it suitable for a wide range of financial activities.

Traceability:

Traditional System: Limited traceability as endorsements and transactions are recorded on paper.

MCL System: High traceability. Every transaction and endorsement is recorded on the blockchain, providing a transparent and unchangeable record.

This detailed comparison highlights the significant advantages of MCL over traditional systems, particularly in terms of security, flexibility, and mutual benefit for all parties involved. In summary, the table outlines how MCL innovates in the realm of credit systems by ensuring full collateralization, eliminating the risk of nonredemption, and allowing both issuers and holders to actively earn from the process, a stark contrast to the traditional credit systems.

Conclusion: A New Era of Credit

Marmara Credit Loops isn't just an innovative blockchain project; it's a fundamental rethinking of how credit works in our economy. By ensuring security through full collateralization and transforming the role of the credit holder, MCL paves the way for a more secure, equitable, and profitable financial ecosystem. As we embrace this new era of credit, MCL stands at the forefront, leading the charge towards a more trustworthy and beneficial financial future.

Dive into the discussion about this revolutionary approach to credit and share your insights on how Marmara Credit Loops is reshaping our financial landscape. Explore with us the new horizons that MCL opens!